Improving User Experience

Using AI-driven Gamification

In The CopilotMoney App

This research project demonstrates the potential to change personal finance management (PFM) attitudes by making the saving-money process more engaging, enjoyable, and seamless.

Based on the Copilot Money app’s savings feature design, this research investigates the effectiveness of a personalised adaptive gamification approach in improving users’ saving money experience.

Role

Researcher, UX/UI Designer

Deliverables

Research paper, mobile app feature prototype, video presentation

Tools

Figma, Miro, Notion, Google docs, PowerPoint

Time span

7 months

The Problem

Existing and potential Copilot Money app users are struggling to save money using the mobile application because of the lacking savings feature

How might we design an engaging and joyful saving-money experience?

Literature Review

To inform the design of the savings feature, I conducted a comprehensive literature review across multiple domains to explore existing research, identify knowledge gaps, and uncover opportunities for innovation.

The review confirmed that AI-driven gamification effectively boosts user engagement and motivation in education and healthcare, but its potential in fintech remains underexplored. This gap underscored the need to investigate user experiences with personalized and adaptive gamification in fintech applications.

UX design

Gamification

Fintech

AI

Research Question

How personalized and adaptive gamification approach can be leveraged to enhance user engagement and satisfaction with the savings feature?

Approach

For this project, I employed an integrated strategy that combined Agile methodology, User-Centered Design, and the Double Diamond method. The Agile methodology has broken my project into six manageable sprints, delivering all important features quickly, and allowing for earlier feedback and refinements. A UCD approach was the central focus of my project, as I aimed to demonstrate how AI-driven gamification could be designed and how users experience gamification. The Double Diamond process ensured a structured and iterative method to quickly deliver an easy-to-use prototype that resonates with users’ needs and preferences.

User Centered Design

Agile Methodology

The Double Diamond

Solution

An AI-driven gamification approach, proven effective in enhancing user experience across various domains, was employed to create an engaging and delightful savings experience in the CopilotMoney app. Specifically, I developed the user-centered design of the saving money feature that utilizes AI technology to personalize interactions, adapt to user progress, financial changes, and user behavior.

Personalised Savings Goals and Insights

A tailored feature that uses AI to set customized savings goals and provide actionable, data-driven recommendations

Savings Challenges

A gamified feature that encourages users to achieve their financial goals through interactive, goal-oriented tasks and rewards

Financial Forecasts and Smart Progress View

An AI-powered feature that predicts future savings trends based on user data and provides an interactive dashboard to compare monthly and yearly savings progress while reviewing historical performance

Concept Testing

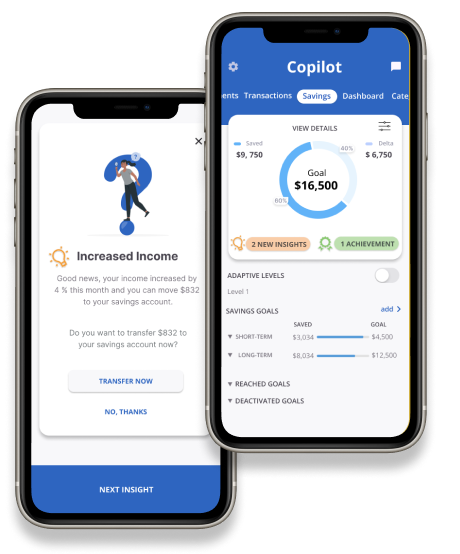

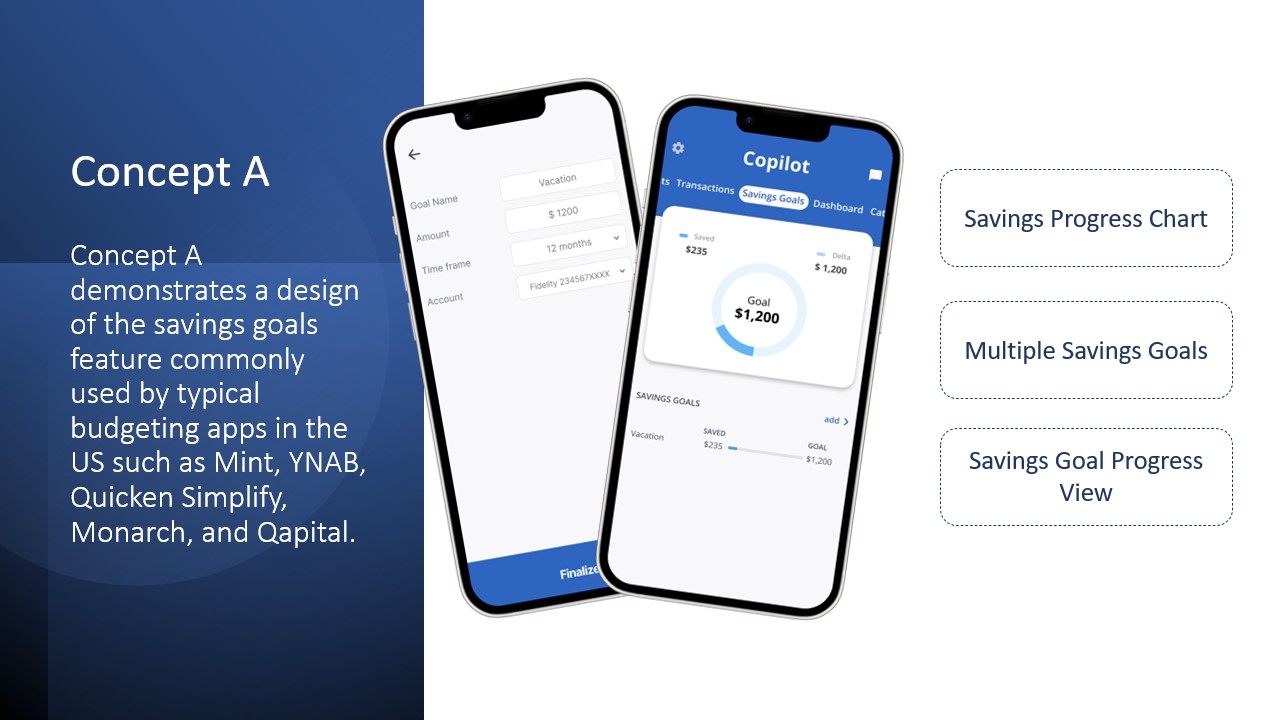

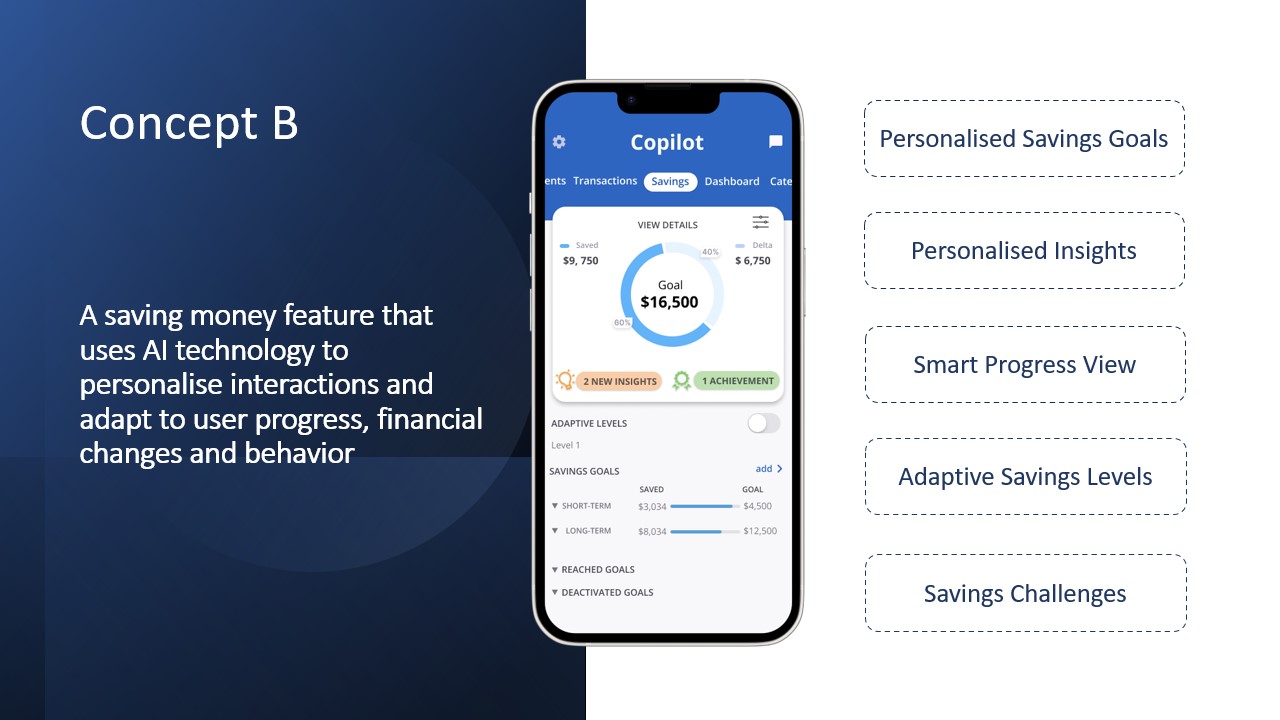

To evaluate the effectiveness of an AI-driven gamification approach, I developed two concepts of the savings feature prototype to compare user experience and satisfaction with each one.

Concept A utilizes a traditional gamification approach, incorporating familiar elements such as savings goals and a visualized progress tracker.

Concept B delivers a personalized, automated, and engaging savings experience tailored to user needs. It leverages AI technology to enable dynamic personalization and adaptive features.

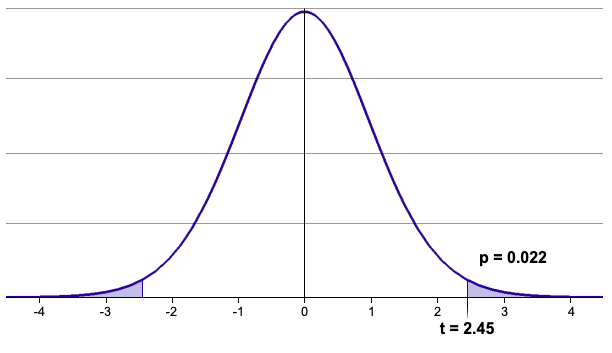

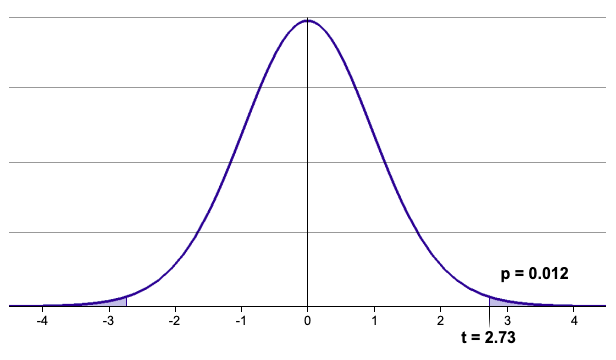

Two concepts of the savings feature prototype were tested with a total of 54 randomly selected participants using an unmoderated prototype testing method, followed by satisfaction surveys. Quantitative data from the surveys was analyzed using the t-test statistical method, revealing that participants who tested Concept B demonstrated significantly higher satisfaction and engagement levels compared to those who evaluated Concept A.

Research Findings

Users reported greater satisfaction and engagement with the savings feature prototype that employed personalized adaptive gamification compared to the prototype that used a non-personalized, non-adaptive approach. This research finding underscores the effectiveness of the AI-driven gamification approach in enhancing user satisfaction and engagement within personal finance management apps.

Final Thoughts

My research journey has been challenging and exciting, allowing me to dive deeply into UX research and design in personal finance management (PFM) applications and the potential of user-centred design, AI, and gamification to enhance user experience. My initial motivation stemmed from a personal interest in how technology can transform mundane financial tasks into engaging and joyful experiences. My background in psychology, economics, graphic design, and banking has been instrumental in the development of this project.

This project has had a significant impact on my growth as a UX design professional. I gained extensive knowledge in desk research, academic writing, research methods, and statistical analysis. Additionally, my understanding of Fintech UX design, gamification, and AI technology has well-prepared me for a future career in UX Design and UX Research industry.